What is The Job support scheme?

The job support scheme is a government lead scheme designed to protect and preserve jobs in businesses who are in lower demand over the winter months due to Covid-19. This scheme has been implemented so workers can stay part of a workforce and not struggle to find more income to support themselves and they’re families.

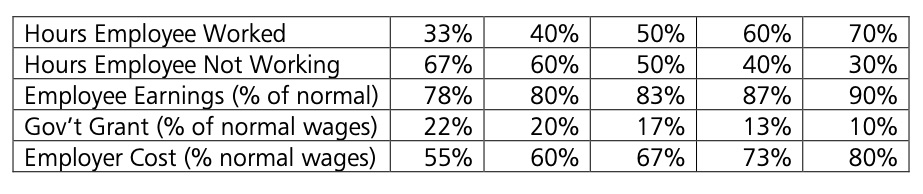

The job support scheme is aimed to help employees who have been forced to work reduced hours; employees will be placed on reduced hours if the business does not require the staff and/or cannot afford to pay you your full contracted hours. When an employee is on reduced hours, they must work a minimum of 33% in the business to qualify for the scheme.

The idea is that employers will pay their staff for the number of hours worked in their business as usual. However, for the hours you are contracted but you do not work, the government and your employer will split the pay. The government will pay 1/3 of hours not worked (capped at £697.92 a month) and your employer will pay the rest up to 80%. This means employees will earn 80% pay of the hours they do not work.

In summary you will take 100% of your wage for actual hours worked in the business and 80% wage for the hours you are contracted but you did not work in the business, due to unforeseen circumstances with COVID-19.

Eligibility

Employers– All employers with a UK bank account and UK PAYE schemes can claim the grant. Employers from large businesses will need a financial assessment test as this scheme will only be provided to those who are experiencing a low turnover due to Covid-19 impact.

Employees– Employees must be on an employer’s PAYE payroll on or before 23rd September 2020. Submission notifying payment of an employee to HMRC must have been made on or before 23rd September 2020.

For the first three months of the scheme employees will be required to work at least 33% of their usual hours. After those three months it is up to the government to increase this minimum hour’s threshold.

How to claim

The job support scheme will be active come the 1st November 2020 and run until the end of April 2021. Employers will be able to make a claim through the Gov.uk website from the 1st December 2020. Payment after a successful claim will debited on a monthly basis. The claim can only be submitted in any given pay period, after payment to the employee has been made and that payment has been reported to HMRC via a Real time information return (RTI).

- HMRC will check claims and retain any claims found to be fraudulent or showing incorrect information. A full claim must be made by the employer and agreed with their staff. Employees must be notified in writing of any changes made to their contract.

Example given by the government

- Beth normally works 5 days a week and earns £350 a week. Her company is suffering reduced sales due to coronavirus. Rather than making Beth redundant, the company puts Beth on the Job Support Scheme, working 2 days a week (40% of her usual hours).

- Her employer pays Beth £140 for the days she works.

- And for the time she is not working (3 days or 60%, worth £210), she will also earn 2/3, or £140, bringing her total earnings to £280, 80% of her normal wage.

- The Government will give a grant worth £70 (1/3 of hours not worked, equivalent to 20% of her normal wages) to Beth’s employer to support them in keeping Beth’s job.

For more information on the Job support scheme please visit Gov.uk

(E) enquiries@advaloremgroup.uk or (T) 01908 219100 (W) advaloremgroup.uk